Inspired to write

“As a young professional, I was incredibly fortunate to be inspired and guided into tax and legal writing by Mr. Les Szekely, who was a tax partner at the time. Working under his mentorship, I developed a deep passion for simplifying complex legal concepts.”

Transforming law into actionable strategies

“My focus has always been on practical implementation: How can we apply these insights in a way that truly benefits clients, not just describe the law so that it remains jargon for our clients.”

“During my university law teaching career I also focussed on simplifying difficult concepts and show students practical uses. “

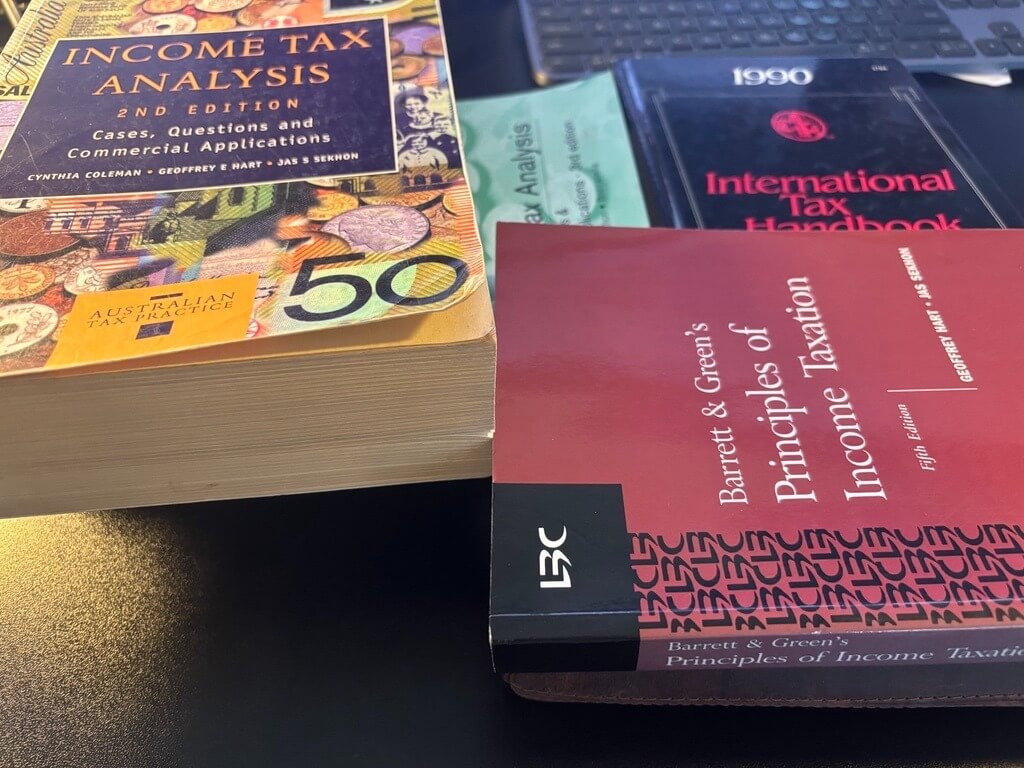

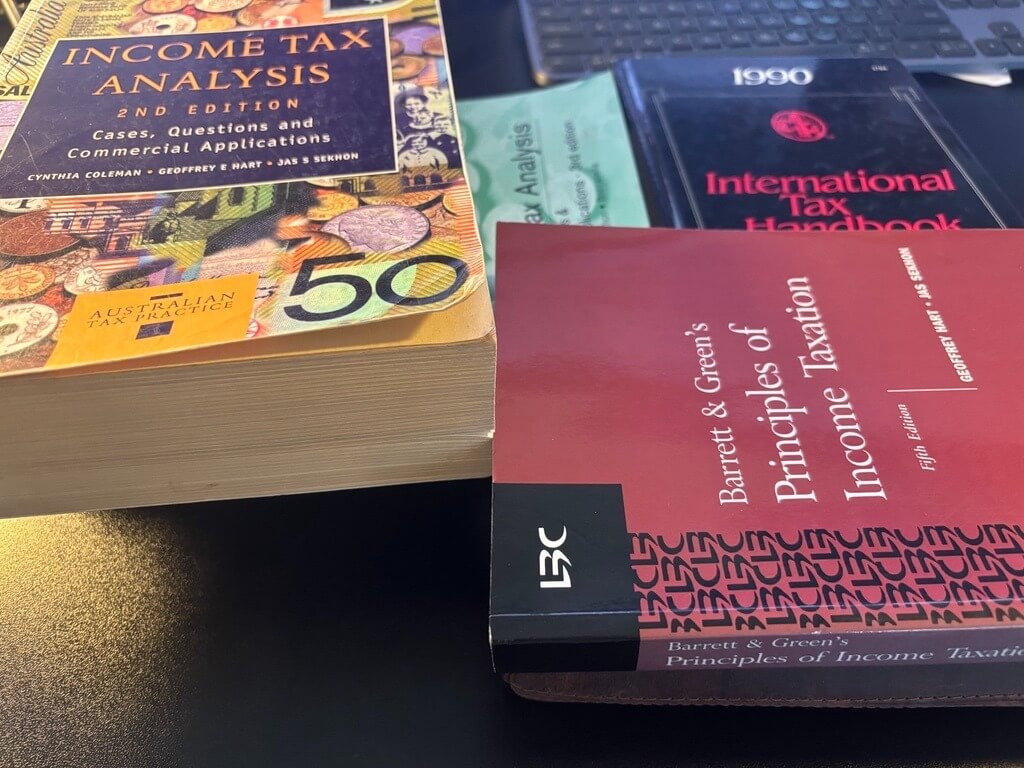

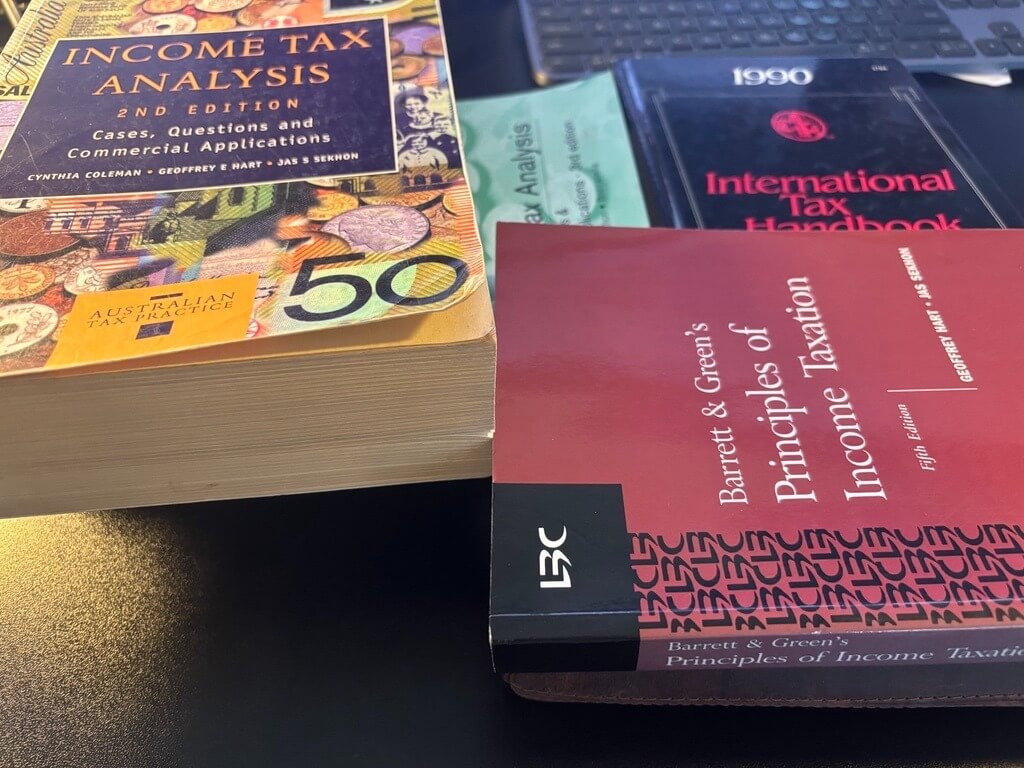

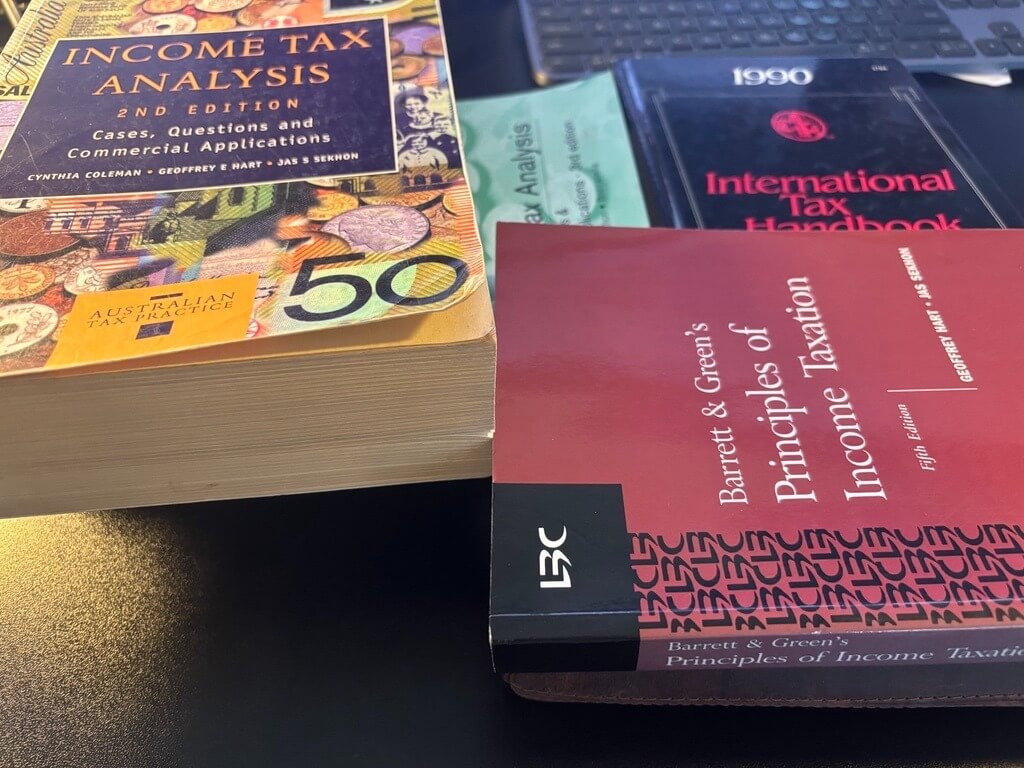

Books and Loose-Leaf Publications & Works

Income Tax Analysis (1998) Book

Questions and Answers Manual (1997)

Income Tax Analysis (1997) Book

Questions and Answers Manual (1996)

Law Book Company (now Thomson Reuters), Practical answers and solutions to problems. Teaching aid companion to textbook.

Barrett and Green's 'Principles of Income Taxation (1995) Book

International Tax Expatriates & Migrants Manual (1992) Looseleaf

CCH, Co-editor co-editor and author of certain chapters on behalf of Horwath International. Major international practitioner reference work.

International Offshore Financial Centers Manual (1992) Looseleaf

CCH, Co-editor co-editor and author of certain chapters on behalf of Horwath International. Major international work.

International Tax Planning Manual CCH (1988-92) Looseleaf

Co-editor and author of certain chapters on behalf of Horwath International. Quarterly text for over 33 countries Major international work.

International Tax Handbook CCH (1990)

Concept creator annual hard cover summary and author of general principles 1989 co-editor and author of certain chapters on behalf of Horwath International.

The Investment Planning Guide (1991) Loose leaf

“I was fortunate to be able to provide the then leading global publishers, CCH, Butterworths and Law Book Company, practical solutions, strategies and ideas for publication.”

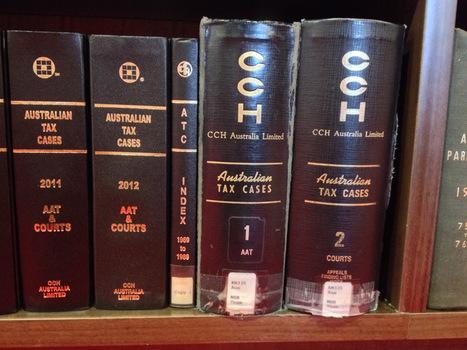

Journal Articles

“The UAE as a true global financial centre”

It is a well known fact that the United Arab Emirates (UAE) does not levy any income or capital taxes.

“Company Dividend Policies After Imputation: Tax Strategies"

CCH Vol. 1 pages 22-33 Sole author- feature article in CCH Journal of Australian Taxation 1989

“Tax Effective Investment Structures-Considerations for Foreign Investors..."

CCH Sole author Feature practitioner article-. CCH Journal of Asian Pacific Taxation.

“Tax Action Digest (monthly)"

CCH Feature Practitioner Articles (10) from 1989-91 : Partnerships & Taxation, Dividend Policies, and International tax planning: Tax Shelters and US Real Estate Investments. 1990-89

"Tax Literature Review"

“The UAE as a true global financial centre”

It is a well known fact that the United Arab Emirates (UAE) does not levy any income or capital taxes.

“The New Debt Creation Rules”

"A Comparative Analysis of the Recent Family Law .."

This article is the first of its kind to compare the law and law reform on the division…